Most people think a deed and title mean the same thing. However, it’s important you know the difference if you are about to enter into a real estate transaction.

A Property Deed

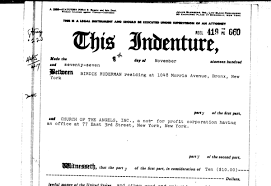

The easy way to know the distinction is to think of the word “deed” as an action word, as in ‘he did a good deed”. In real estate parlance the term also carries a certain amount of action. The deed performs a job. It’s a legal document conveying the ownership rights to a property. It must be signed by both the buyer and seller and confirms that the property has changed owners.

Can another person be added to the title once a deed had been signed?

Yes, another document called a Quitclaim Deed has to be signed in order for this to occur. When executed and notarized, the Quitclaim Deed overrides the existing deed. This new deed transfers the share of ownership

Advantages of a Quitclaim Deed

Instead of selling a property and incurring the fees associated with a sale, adding someone to the deed can have a similar effect, allowing the initial owner to be refinanced off the deed at a later date. This is often used between family members or business partners or when transferring a property into a corporate entity from a personal name.

A Property Title

Once a deed has been signed the property title confirms the new owner of the property. Unlike a deed, a title is not a physical document but rather a concept saying who the owner is. It’s for this reason — one being a document and one not — that the deed and the title often get confused. Without a deed, the title could be seen to be meritless if there were challengers to the validity of ownership, assuming that there was no title insurance.

The steps you need to take to get the deed and title of a property

Firstly, a lender or buyer’s attorney (if purchasing cash) will hire a title company to conduct a search. This confirms that the seller is legally able to transfer the title of the property to you and that there are no “clouds” or liens against the property.

If there is a clean title, the title or escrow company will record the new deed with the county assessor’s office or courthouse, whichever process is applicable to your area. Confirmation of this should occur a few weeks after closing.

Protecting the title

This is where title insurance comes in. Title insurance protects against old liens which may have been missed and can come to light years later. To protect against any financial loss, two types of title insurance exist: owner’s title insurance and lender’s title insurance. Both are paid at closing.

(Image courtesy of patch.com)