Buying a property all cash is a luxury few can afford. For the fortunate, it means a number of cumbersome fees can be eliminated. A mortgage recording tax is one.

Strictly speaking, it’s not a bank that charges the mortgage recording tax; it’s the state and city. They do this for the ‘privilege’ of recording a mortgage on real property located within the state. In addition, New York City imposes local taxes on mortgages that are recorded in the five boroughs.

What are the mortgage taxation rates in NY State?

According to New York’s Department of Taxation and Finance, the following rates apply when getting a mortgage for a property in the Empire State.

- A basic tax of 50 cents per $100 of mortgage debt or obligation secured

- Special additional tax of 25 cents per $100 of mortgage debt or obligation secured

- An additional tax of 25 cents per $100 of the mortgage debt or obligation secured (30 cents per $100 for counties within the Metropolitan Commuter Transportation District). The recording of a mortgage is subject to the additional tax unless the additional tax has been suspended in the county where the real property is located. If the real property is principally improved or to be improved by a one- or two-family residence or dwelling, the first $10,000 of principal debt or obligation secured by the mortgage is deducted in computing the additional tax

- City or county mortgage tax of 25 to 50 cents per $100 of mortgage debt or obligation secured, where applicable

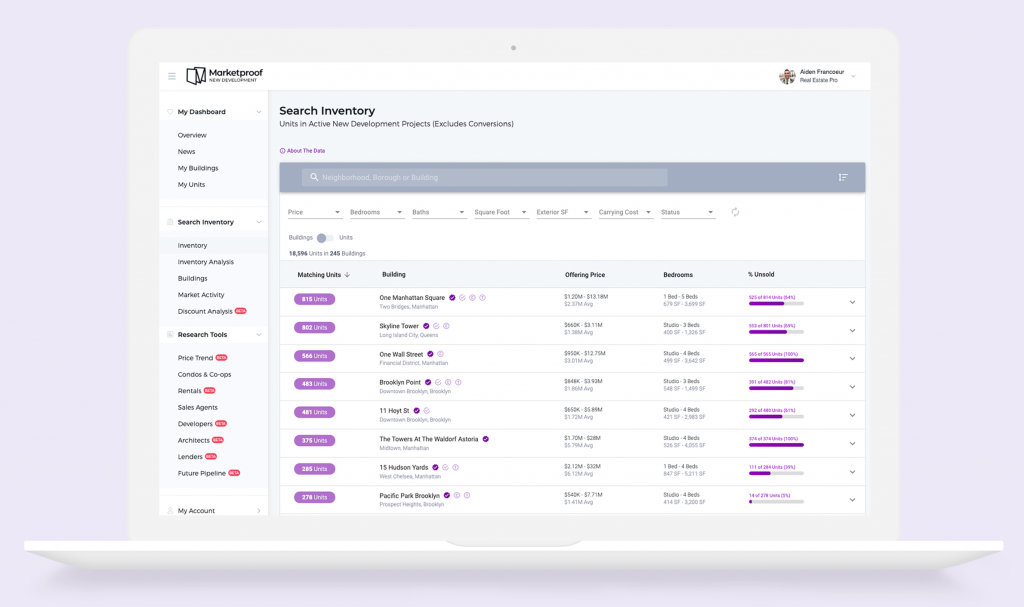

Check out Marketproof New Development for the most information anywhere on NYC condos.

Other things to bear in mind

- In NYC, the buyer pays a mortgage recording tax rate of 1.8% if the loan is less than $500,000 and 1.925% if $500,000 or more. Buyers of commercial property pay 2.55%

- The tax only applies to condos, townhouses, and single-family homes, classified as “real” property. Co-ops, however, are classified as ‘personal’ property because you are technically buying shares in a corporation, not real property

How much Mortgage Recording Tax will you pay on a purchase of $1 million?

Purchase price: $1,000,000

Down Payment $200,000 (20%)

Mortgage $800,000 (80%)

Mortgage Recording Tax: $15,370 = ((1.925% x $800,000) – $30)

- Note that if the loan was less than $500,000, the tax would be 1.8% and not 1.925%

How to avoid paying Mortgage Recording Tax

Buy A Co-op

Mortgage Recording tax only applies to “real” property, whereas a co-op is classified as “personal property”. See explanation above.

Get a CEMA

For the sophisticated buyer, a CEMA (Consolidated Extension of Modification Agreement) is an option. It basically involves assigning the owner’s current mortgage to the new bank, thus eliminating the need to record another one and pay a mortgage tax. Of course, a CEMA requires the cooperation of the seller’s lender and the seller. Also, there needs to be an existing mortgage.

However, a CEMA would in all likeliness only eliminate some of the mortgage recording tax because it is unlikely that a seller will be selling a property for exactly the same as what they owe on it. There will probably be another loan to cover the increased sales price.

Ideally, a buyer and seller should split the expenses and the savings equally. However, a buyer would like to get all the savings. It will be up to a seller’s attorney to negotiate for an even split.

Where is the Mortgage Recording Tax in NYC Filed, and Who Collects It?

For mortgages in Manhattan, Brooklyn, Queens, and the Bronx, the mortgage recording tax is collected by The New York City Register Office, and the property documents are recorded online using ACRIS, NYC’s online database of public property records. The Richmond County Clerk collects it in Staten Island, where documents must be recorded in person.

Form MT-15, otherwise known as the Mortgage Recording Tax Return, needs to be filed to record your mortgage.

If you refinance your house, do you have to pay a Mortgage Recording Tax again?

If you are using the same lender and simply changing the rate, then it is unlikely that you will have to pay the Mortgage Recording Tax again. However, if you are using another lender, there is a chance you may have to pay again, especially if they do not handle the paperwork to circumvent this. It is best to bring this up long before the closing, when you are still deciding which lender to use.

Is the New York Mortgage Recording Tax deductible?

It can be used to offset capital gains taxes as part of your settlement costs when you go to sell your property, but it can’t be deducted in the same way real estate property taxes are on a yearly basis.

Getting started with Marketproof

With Marketproof New Development, you get the most possible information about new NYC condos to craft the most competitive offer price. You can easily search both publicly listed properties and unlisted off-market properties not available on popular listing sites. Marketproof can increase the inventory you see by 9-10x what you may see on other sites. Create an account today, and get a 7-day free trial.

Top photo courtesy of 543 West 122nd St.