Hundreds and sometimes thousands of dollars in closing fees are thrown around like confetti when buying a home in NYC. Of course, there are the big-ticket items such as a broker’s commission and mortgage transfer taxes. There are also a lot of smaller lender-associated fees which when combined can make for a humbling experience if you’re not expecting them. Here’s a break down of typical costs with a brief explanation.

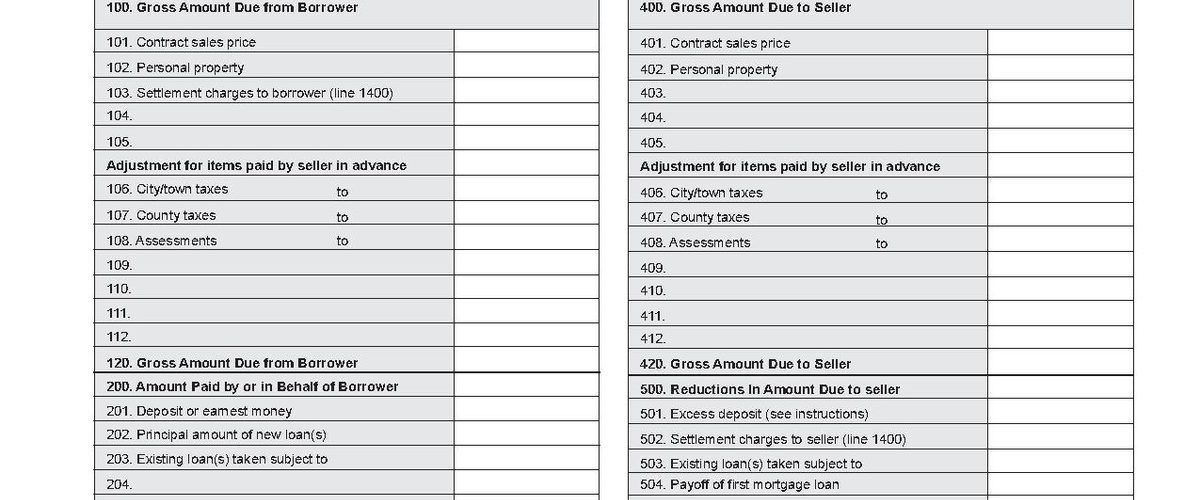

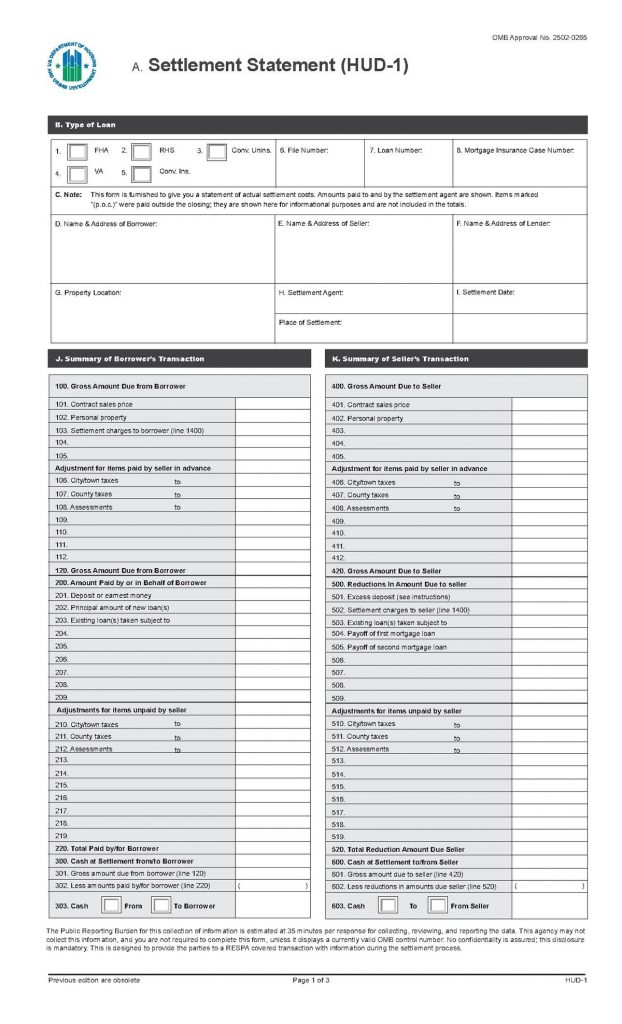

Below is an HUD-1 Settlement Statement.

$750 — Bank Attorney Fee

- One thing you can be sure of is that the bank is going to get paid. This fee is not open for negotiation unless your next-door neighbor happens to be the bank’s attorney. Expect this to be around $1500 to $4000, depending on the size of the transaction.

$750 — Bank Loan Origination Fee

- This is sometimes referred to as a junk fee. It’s just a fee that the bank adds on because they have deigned to give you a loan. Often this can be negotiated away. Some banks even make it a point of claiming they will not charge an origination fee. Beware, though because other fees could crop up in its place elsewhere.

$450 — Property Appraisal Fee

- The underwriting process has sped up considerably since all banks have done away with reams of paperwork and gone digital but still expect to pay this fee for the person going through all your docs.

$1000 — Title Search & Recording Fees

- Well worth the money to guarantee you and only you will own your new home

$200 — Financing/Recognition Agreement Fee

- This applies to co-ops only