A condo developer defaults when they are unable to sell apartments and do not have the funds to pay off their loans. If this happens, it is likely that the building’s lender will either take over the building or auction it off.

A developer defaulting in this way doesn’t happen often. They have the ability to refinance, but it does happen.

Condo financing basics

The developer typically sets up a company (an LLC) that will own the building when planning a condo project. The company then usually takes on what is known as a mezzanine loan to provide financing for the project. Some developers are in a strong enough financial position that they do not need to take out mezzanine loans.

To finance the construction of the building, the developer will take out a mortgage. All of the units in the building will be collateral for the mortgage.

The mezzanine loan is subordinated to this mortgage. This means that the mortgage gets paid first if something goes wrong. A mezzanine loan, since it is not in the first position and is taking on more risk, will come with higher interest rates — and more potential upside, too.

The mezzanine lender, perhaps a private equity firm or other investor, may happily take over the asset if the developer cannot hold up their end of the bargain. This is often part of what professionals call a ‘loan-to-own’ strategy.

But the mezzanine lender may also not want to own the building and may instead hold an auction if the condo defaults. In this case, another investor may take control of the asset. But it is also possible the lender will end up in control, perhaps by launching a credit bid. A credit bid means the lender leverages the debt they own to make a bid for the asset.

What happens to condo owners and buyers if a condo defaults?

The most immediate issue for condo owners and buyers if the developer defaults and walks away from the building is that common charges may increase.

If 60% of the building’s apartments are unoccupied, the remaining 40%, the condo owners, may need to pick up the slack on the missing common charges to keep the building running. Ultimately, the mezzanine lender or another investor will take over the building and assume responsibility for the excess common charges.

A second problem could arise if the developer decides to rent out apartments in order to earn some cash while buyers remain elusive. If the developer rents out a bunch of apartments, the value of a buyer’s condo may decrease. That is because the rentals tell prospective owners that the building is not as attractive to other potential owners.

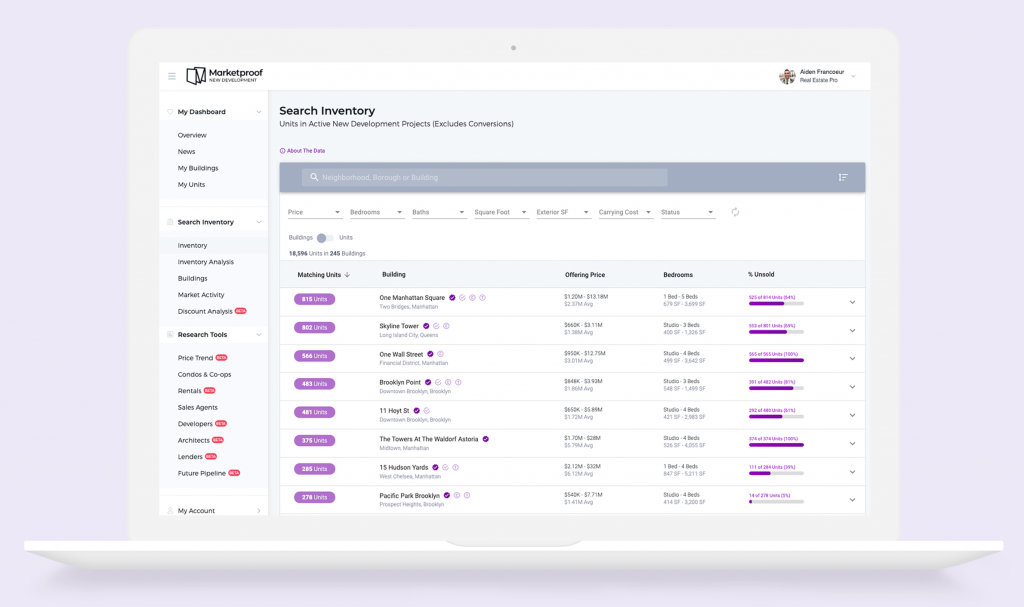

Check out Marketproof New Development for the most information anywhere on NYC condos.

Does the developer defaulting affect a condo unit’s mortgage?

A default of a developer does not directly affect a condo unit’s mortgage. The building’s finances and the condo unit’s mortgage are separate. Once a condo is sold, it is removed from the collateral for the building’s mortgage.

The condo unit is now the collateral for the condo’s mortgage. If the developer has to hand the building over to the mezzanine lender or a different investor, that will have no direct bearing on the unit’s mortgage.

What is the Uniform Commercial Code?

The Uniform Commercial Code (UCC) is a set of laws that dictates the mezzanine lender’s options if the developer cannot sell apartments and defaults. All US states adopt this law.

The UCC provides guidelines for how the lender may go about taking over a building. One of these methods is a strict foreclosure. This means the lender takes the building, or collateral, and considers the developer’s debt paid. Other methods may include a public sale. In this case, the lender needs to provide other potential buyers the opportunity to bid on the condo building.

The bottom line for prospective condo buyers

Buying a condo in a new development that hasn’t sold a majority of the condos comes with some risk. That is why the government will typically not buy mortgages unless the project is 50% sold, though exceptions can be approved enabling a lower percent.

But new developments also provide some of the most attractive options in today’s real estate market. You can protect yourself — and potentially benefit greatly — if you know your options.

New condos are also selling with discounts, and Marketproof research shows that if you bought a condo in Manhattan in 2009 during the last downturn and sold in 2018, you could have seen more than a 50% return.

The upshot is that you should consider new developments, but you need optimal information at your disposal to make a wise purchase. That is why you should check out Marketproof New Development.

Marketproof New Development provides the Internet’s most comprehensive information about new NYC condos. It is the only site that will show you shadow inventory, or all the condos for sale that the developer has not publicly listed. MND also tells you how many apartments are in a building, how many have sold and closed, and what their prices are.

In other words, Marketproof New Development’s data is exactly what a prospective new condo buyer needs to determine how well the project is going and how high the risk is.

Getting started with Marketproof

With Marketproof New Development, you can easily search both publicly listed properties and unlisted off-market properties not available on popular listing sites. Marketproof can increase the inventory you see by 9-10x what you may see on other sites. Create an account today, and get a 7-day free trial.

Top photo courtesy of 302 East 96th Street.