A developer takes out a condo inventory loan when they need to adjust the financing of a condo building to meet the market. The loan allows developers to repay maturing construction loans and hold units for sale at a later date.

Mid-market condo developers have traditionally used these loans. But the luxury sector is increasingly using them as well.

Why are lenders willing to offer inventory loans?

The main reason lenders like condo inventory loans is because they come with relatively low risk. The condo project they are lending on is already a complete, viable commodity. Lenders are not looking at a hole in the ground. The sponsor already has skin in the game, having invested time, effort, and money to complete the building.

A temporary lull in sales often occurs in a soft market. However, if the overall project is in good shape, it makes sense for a lender to offer a condo inventory loan. As a result, they will receive interest payments every month capitalized through a reserve.

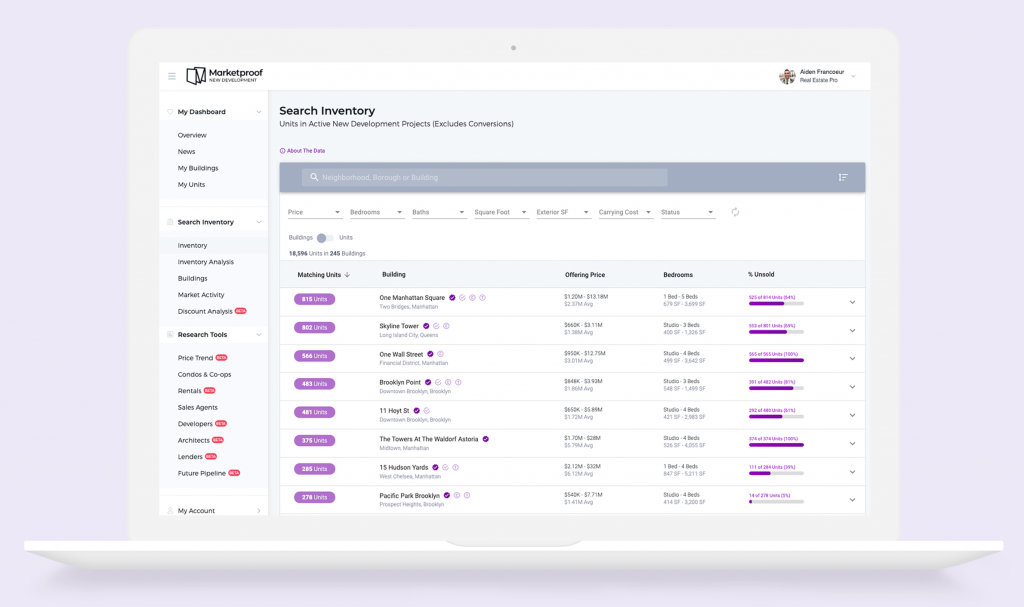

Check out Marketproof New Development for the most information anywhere on NYC condos.

Why are sponsors keen to engage in these loans?

These are very advantageous to a sponsor because the loan gives them more time to achieve their prices for units. In some instances, they are able to recapture equity and lower their interest rates by 1.5 to 2% by switching out of a construction loan.

It is a lender’s goal to lend money, and in lieu of limited acquisition projects to fund, inventory loans offer a good alternative. As competition to fund these loans increases, borrowers stand to benefit from competitive interest rates.

A lender will be more enthusiastic to become involved in a project while there is still a large inventory. This means that the more desirable condos in a building are still available as opposed to just the less desirable ones. This balance typically emerges when a development has been on the market for a while because developers tend to sell cheaper condos first.

The advantage for the lender in this situation is that they get to keep the loan out longer. Thus, with this in mind, they are generally more favorable to taking out an existing loan versus pure repatriation of sponsor equity late in the sales process.

What happens if the condos do not sell?

If the sponsor is unable to sell the condos and defaults on their loans, it is likely that the building’s lender will either take over the building or auction it off.

The lender, perhaps a private equity firm or other investor, may happily take over the asset if the developer cannot hold up their end of the bargain. This is often part of what professionals call a ‘loan-to-own’ strategy.

But the lender may also not want to own the building and may instead hold an auction if the condo defaults. In this case, another investor may take control of the asset. But it is also possible the lender will end up in control, perhaps by launching a credit bid. A credit bid means the lender leverages the debt they own to make a bid for the asset.

How do condo inventory loans help buyers?

The main advantage to a buyer is that this type of loan aims to stabilize the financing of a condo. A financially stable building is one that runs more smoothly. This stability helps to maintain property values.

Are there any disadvantages to buyers?

For new buyers looking to snag a deal in a down market, a condo inventory loan isn’t much help. It enables the sponsor to keep sales prices elevated.

How are typical condo inventory loans structured?

As with most loan programs, there are usually several options depending on the type of project. But certain guidelines will normally apply. These are:

- Loan terms are usually 12-24 months with possible extensions.

- Leverage is generally capped at 60-70 percent of bulk sellout value. The lender will establish value based on a combination of an appraisal, the sponsor’s estimated sellout value, broker conversations, and, most importantly, other condo sales within the building and competitive properties.

- There are various levels of the pre-payment penalty.

- The lender will establish minimum release prices on an individual unit or $/SF basis to make sure that sufficient value remains in the unsold condos as each condo is sold off.

- Cash flow leakage from sales can be negotiated and allows some portion of the net sales proceeds from individual unit sales to be returned to the borrower leaving a portion of the inventory loan outstanding.

Getting started with Marketproof

With Marketproof New Development, you can easily search both publicly listed properties and unlisted off-market properties not available on popular listing sites. Marketproof can increase the inventory you see by 9-10x what you may see on other sites. Create an account today, and get a 7-day free trial.

Photo above courtesy of 215 Chrystie St.