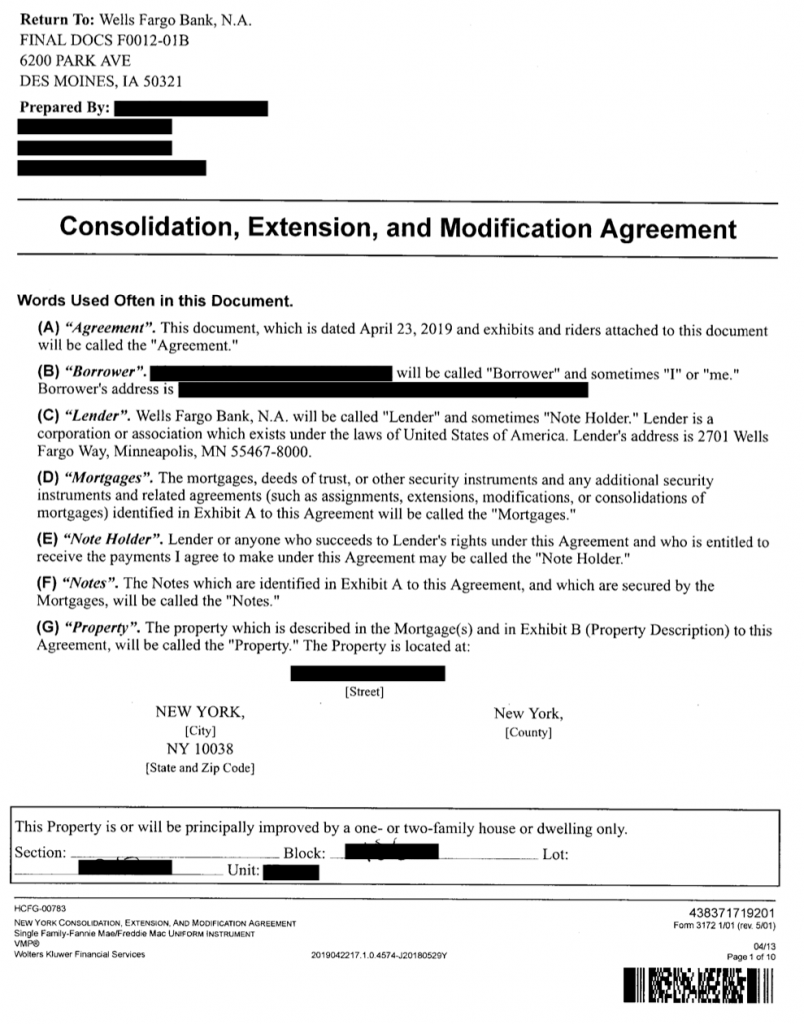

In New York, a CEMA (Consolidation, Extension, and Modification Agreement) is an agreement where a buyer and seller agree to cooperate to save on state taxes.

Here’s how a CEMA works: The buyer assumes responsibility for the balance of the seller’s mortgage on the property and borrows new money required to close. Next, the buyer consolidates the two notes and two mortgages into one.

How does a CEMA help the buyer?

A CEMA can result in a substantial saving on the buyer’s Mortgage Recording Tax.

Mortgage tax is probably the biggest expense (barring the down payment) a buyer will encounter as part of their closing costs. Buyers are charged 2.05 percent of the borrowed amount for new mortgages below $500,000. The rate increases to 2.175 percent when the amount borrowed surpasses $500,000 for 1-3 family residential units and individual condos units. For larger multi-family and commercial properties with new mortgages over $500,000, the interest rate is 2.8 percent.

In New York, the mortgage recording tax only applies to new borrowings, so the buyer will only have to pay mortgage recording tax on the difference between the new mortgage and the seller’s existing mortgage principal when a purchase CEMA is transacted.

For example, this can amount to a savings of $9,200 on a condo with a sales price of $1 million and a residual mortgage balance of $400,000, when the buyer finances at 80 percent LTV. Without a purchase CEMA, the mortgage recording tax would be $17,400. However, the mortgage recording tax on $400,000 is $8,200. The savings come from the buyer assuming the original mortgage.

Check out Marketproof New Development for the most information anywhere on NYC condos.

Why would a seller be willing to allow a buyer to assume their mortgage?

The seller wins because they get to save on their transfer taxes. In New York this is 0.4 percent of the sales price. A property being sold for $1M with an outstanding principal balance of $400,000 will only be liable for taxes on $600,000 — the home equity being transferred — as opposed to $1 million. Thus, the NYS transfer taxes in this example would equate to $2,400 instead of $4000, around 40 percent in savings.

It’s worth noting, however, that the more costly NYC transfer taxes (1-1.425 percent of the sales price) are not affected by the use of a purchase CEMA loan.

Another Example of a Purchase CEMA

- Sales price: $1 million

- The seller has an existing unpaid principal of $500,000 and wishes to finance $800,000 of the purchase price

The buyer will do the following:

- Pay the seller $500,000 and assume the seller’s $500,000 mortgage to equal the sales price of $1 million

- Obtain a “new money mortgage” for $300,000

- Consolidate the seller’s $500,000 mortgage and the buyer’s new money mortgage into a single $800,000 loan with a new rate and term which is equal to the rate and term they would have otherwise received with a conventional $800,000 loan.

The consolidated mortgage results in a single lien against the property, and the original underlying mortgage is no longer deemed a liability, having been modified by a CEMA agreement.

How much do attorneys charge to do a CEMA?

Obviously, attorney’s fees can differ widely, often based on the size of the transaction, complexities, and location. It’s usual, though, to expect a fee of $400 to $1,000 for preparing a purchase CEMA.

Where problems arise in negotiating purchase CEMAs

Problems can arise because one or both parties may be inexperienced in purchase CEMAs and unaware of their benefits. Both parties need to be on board for this type of transaction to work.

If a seller declines to let their mortgage be assumed because they think it’s some kind of scam and that they will still be liable, they may balk. This is where having a good seller’s attorney to explain things comes in.

How sellers can negotiate purchase CEMAs to their advantage

Both parties save money with a purchase CEMA, but a buyer saves around 5.75 percent more in mortgage taxes than a seller saves in transfer taxes. A seller can negotiate to split the savings equally.

Why purchase CEMAs can be all-around winners in new developments

If a buyer is using a purchase CEMA when buying new construction, they will need a developer to be on board. In this instance, the developer holds all the cards. A purchase CEMA will only be appealing to them if the develop offers to pass on the savings to the buyer.

Why would a developer do this? Because it allows them to maintain the recorded purchase price while giving the buyer a big discount in closing costs.

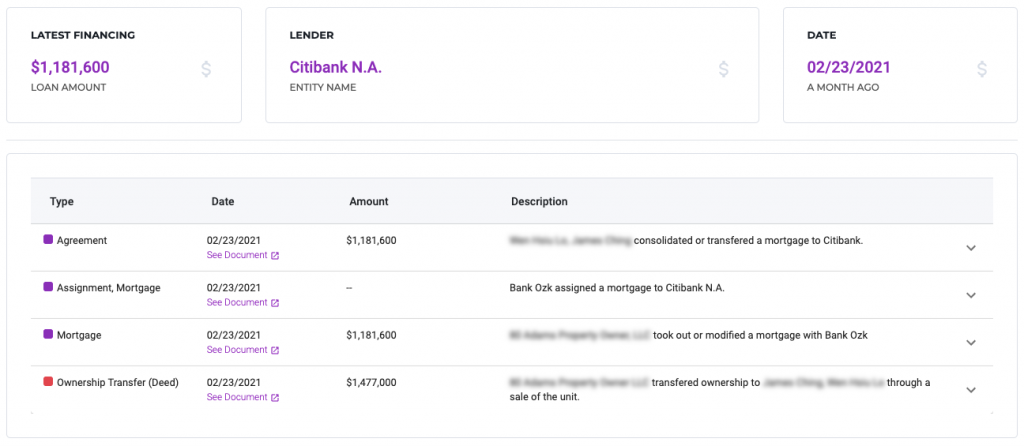

For example, consider this agreement for a unit in a Brooklyn new development. The sponsor, had taken out tens of millions of financing from a bank. The sponsor severed a part of their mortgage, $1,181,600, and transferred it from their bank to the buyer’s. That severed loan then became the loan of the new buyer.

The benefit of this arrangement is that the new buyer saved on mortgage recording tax. Instead of paying 2.175% tax on a $1,181,600 mortgage, which would cost the buyer about $25,700, the buyer paid nothing. The seller likely used this as a discount to incentivize the purchase.

Getting started with Marketproof

With Marketproof New Development, you can easily search both publicly listed properties and unlisted off-market properties not available on popular listing sites. Marketproof can increase the inventory you see by 9-10x what you may see on other sites. Create an account today, and get a 7-day free trial.

Top photo courtesy of The Belnord.