In an unregulated market economy, suppliers sell goods and services at the highest price buyers are willing to pay. If supply increases faster than demand, prices will fall. If demand increases faster than supply, prices will rise. This is price equilibrium.

NYC real estate is not an unregulated market economy. Ask any developer, builder, lender, or broker. One of the core capabilities of all market participants is managing regulation.

The goal of these fragmented regulations is, of course, to protect consumers, brokers, developers, and others. But rather than protecting the various players in NYC real estate, the regulations often burden them and sometimes encourage withholding information in order to achieve desired results, including higher prices.

In the wake of Covid, market participants could benefit from sharing just how much supply exists and when sales take place.

Here’s why.

NYC new developments lack transparency

The New York State Attorney General’s Real Estate Finance Bureau regulates the NYC new development market. Developers submit offering plans to the AG’s office, which approves them if they meet legal requirements. A developer can begin selling when the offering plan is approved.

The role of an offering plan in selling condos is similar to the role of a prospectus in an IPO. The offering plan tells you how many units are available, at what prices, and lays out the plan for the building as well as the risks of which a buyer should be aware.

Offering plans are public documents. But how do you get your hands on them? If you go to the SEC website, you can easily download any IPO prospectus. If you go to the AG website, you will be disappointed. The AG publishes only about 25% of offering plans, and even less when it comes to important plan amendments. The further back you go, the lower the publishing percentage.

Check out Marketproof Pro for the most information anywhere on NYC condos.

Existing regulations hide supply

The market for brokers is primarily regulated by REBNY, a trade organization. Brokerages agree to abide by the terms of REBNY’s Universal Co-Brokerage Agreement, which sets the rules regarding cooperation and compensation related to exclusive listings.

When a developer hires a broker as the sales agent for a building, the broker can list properties on REBNY’s listing system, the RLS. The RLS is an efficient way to spread listings to member firms, giving them the opportunity to bring buyers. Importantly, though, brokers don’t have to list properties on the RLS. In fact, they generally do not. According to Marketproof data, around 10% of available new development properties are listed on the RLS at any given time.

When it comes to resales, REBNY requires that after a listing goes into contract, brokers change the status of a listing in the RLS to ‘contract signed.’ This requirement is a part of the cooperation among brokers, signaling to a buyer’s broker that a unit a client may have been interested in is no longer available.

NYC new developments

For new developments, though, the requirement to change the status of a listing to ‘in contract’ often doesn’t apply. If, for example, a shadow inventory unit — a unit not listed on the RLS — goes into contract, there is no record in the RLS to update. 50% of sales are for units never listed on the RLS, obscuring a large share of transactions from public view.

In addition, given that so many units are not subject to RLS requirements, not updating the status of units has become the norm. Contracts are held and released in strategic batches, or sometimes not at all. Even units that have been listed on the RLS are frequently not changed to ‘in contract.’ Instead, their status is changed to ‘no longer available.’

The dearth of publicly available data caused by shadow inventory and incomplete updates on contract information means developers have the upper hand when it comes to negotiating prices. By hiding inventory and sales information, developers make it seem like supply is low, allowing them to keep prices high.

But recent shifts in the market suggest there is reason to believe developers and buyers would benefit from more transparency about how much supply exists and when units sell.

Recent trends increase supply

Over the past few years, the NYC new development market has been through three consecutive shocks. First, the 2016 presidential election drove away international buyers, who had facilitated demand for higher-end condos. According to NAR, nationwide, the amount of money they spent on residential real estate dipped 21% from 2017 to 2018 and 36% the following year. Then, the progressive 2019 mansion tax increased costs for deals above $1 million and hit the ultra-luxury market especially hard. Finally, COVID temporarily shut down the market and further discouraged higher-end purchases, putting Manhattan, in particular, at a disadvantage.

In the wake of these shocks, though demand has largely recovered, there is simply too much supply. There is currently over eight years of inventory in Manhattan and four years in Brooklyn.

In addition, COVID and the other recent market shocks have shifted the prevailing trends in NYC real estate. Ultra-luxury purchases by foreign investors have given way to more modest local buyers, who are driving demand for condos in the ballpark of $1 million. The appetite for cheaper digs is fueling interest in Brooklyn and Queens. The average condo in those boroughs sold for just over $1 million and about $800,000, respectively, last year, compared to $4 million in Manhattan.

The result is that the inventory of unsold condos has ballooned to more than 15,000 units, with Manhattan experiencing the largest excess of supply. Of those units, 8,400 are in Manhattan, 3,800 in Brooklyn, and 2,800 in Queens.

Why transparency benefits developers

In current conditions, the approach of hiding supply to provide an illusion of scarcity may not benefit developers as much as conventional wisdom suggests.

In this environment, professional buyers, including both financial buyers, seeing an opportunity in a market they may not generally play in, and real estate buyers whose primary business is financing and developing properties, have stepped in to buy the unsold inventory in bulk. (Retail buyers can also benefit.)

With their deep pockets, these buyers can refinance developers, enabling them to get more time to sell their inventory or purchase inventory at bulk wholesale prices.

Therefore, developers might consider four reasons to share more information with these buyers in a market with an excess of supply.

Firstly, by understanding supply, bulk buyers and professional investors will be encouraged to seize the opportunity for better prices, possibly by buying in bulk. This may be a good deal for buyer and seller.

Secondly, by understanding sales information, buyers will gain greater confidence in projects that are doing well. Sure, this may undercut the scarcity marketing play. But it signals to both buyers and lenders that a project is worth investment at a time when both are wary of subpar market conditions.

Thirdly, selling more condos will keep people in NYC, generate tax revenue for the city and state, and jobs for 1000s.

Finally, the excess supply on the market is no secret. That calls into question how much developers can obfuscate high supply in the first place.

Marketproof Pro tackles this problem

The lack of information in the NYC new development market is precisely why Marketproof created Marketproof Pro.

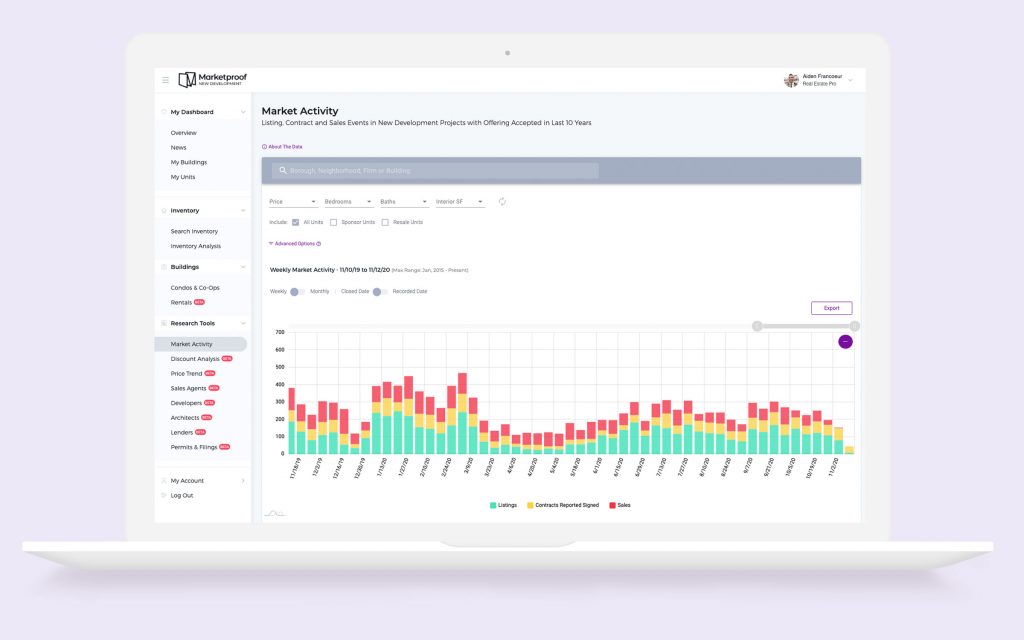

The subscription service builds on the Marketproof public listing site. It is the only real estate platform that provides comprehensive views of new developments. That includes data on shadow inventory and the latest transactions, whether they are listed publicly on RLS or not. The platform’s data covers over 900 buildings currently selling, more than 250 buildings in the future pipeline, and buildings developed in the last ten years. Marketproof can increase the inventory you see by 9-10x what you may see on other sites.

Marketproof uses proprietary software to collect data from the city’s ACRIS database, public records including offering plans, real estate listings, and many other sources in near real-time. Our software automatically aggregates, verifies, cleanses, and interprets the data, presenting the most holistic and accurate view of the NYC new development market.

In addition to an unmatched data supply, Marketproof Pro offers tools to streamline market analysis. You can easily search inventory for specific market segments based on percent sold, project size, unit mix, price, amenities, and other factors. You can search for developers, lenders, and brokers and see how much inventory they have. Soon, you’ll be able to search 20 years of performance to see how buildings and companies have done over time.

Create an account today, and get a 7-day free trial to see for yourself.

The photo above is courtesy of The Luxe Condominium.