A condo offering plan is a disclosure document that lays out the terms under which a sponsor, that is, the owner of the property, can sell you a condo (or parking space or storage bin).

Attorneys who specialize in this area write offering plans. A small group of law firms writes most of the plans in NYC.

The plan is generally several hundred pages long, as, in addition to including information about the building and the properties the sponsor is selling, it includes hundreds of pages of state law-mandated legal disclosures and disclosures that protect the sponsor if something goes wrong.

You can track buildings, from their initial submission through each stage until approval and beyond, on Marketproof Pro.

Why is a condo offering plan important?

If you are buying new construction or a building that is being converted into a condo development, an offering plan explains what you are buying and how it will be run.

If the purchase is for a previously owned condo, in addition to the offering, you should receive board meeting minutes and the financials of the building so that you can see how it is being run.

Beyond that, the offering plan has to first be approved by the attorney general’s office (specifically the Real Estate Finance Bureau). The attorney general is New York’s lawyer. If the sponsor deviates from the offering plan when selling a condo to a buyer, the AG’s office has oversight, and any complaints could result in legal ramifications.

The offering plan also protects the sponsor. Sponsors are only obligated to deliver to buyers what is stated in the offering plan, regardless of what you are told otherwise. Jason Nazinitsky, a partner at the law firm of Marans Newman Tsolis & Nazinitsky LLC, who specializes in writing offering plans for sponsors, says, “There are specific disclosures in most offering plans that state buyers are not relying on any brochures, renderings or any marketing material, but solely the offering plan. This is why buyers should always check what the offering plan states will be included in their unit.”

Check out Marketproof Pro for the most information anywhere on NYC condos.

Are all offering plans the same?

The quick answer is no. There can be some important differences, such as, for example, what the makeup of the condo board will be and when board control moves from sponsor control to the condo owners. This is just one example; there are many others. An attorney experienced in reviewing offering plans for buyers knows exactly where to look.

How do I read an offering plan?

There are two main parts to the plan. The first part explains the features of what you are buying and describes the process for how you will buy it from the developer. This includes the details of the transaction: how the down payment will be handled, when the closing takes place, who pays the taxes, and various closing costs.

There will also be information regarding the developer’s operation of the building until it is handed over to the condo board. Some offering plans dictate a window when the developer will be responsible for repairs and defects after each unit is sold, while others may explicitly disclaim any such window unless it can be proven the repairs or defects were caused by faulty construction, a high burden for buyers to prove.

The second part of the plan will show numerous exhibits, such as the form of the purchase agreement, the condo declaration, and by-laws. The condominium declaration and by-laws are the governing documents of the condominium that govern explain and explain how the condo will be operated in the future. There will also be floor plans and an architect’s description of the components of the building.

The legalese in an offering plan will be confusing to many buyers. Therefore, you should hire a lawyer experienced with offering plans to get a full understanding of what you’re getting into.

Are there any sections of the offering plan I should pay particular attention to?

“Hidden Agendas”

Offering plans can have some “hidden agenda” items that typically favor the sponsor. It is the job of the broker to try and unearth any peculiarities in an offering plan prior to making an offer. Remember that it is the sponsor’s attorney who draws up the offering plan, and it’s hardly surprising that an offering plan is skewed in favor of the sponsor. These law firms are experts in adding nuances to offering plans to suit their clients. Yes, there is oversight from the AG’s office, but this has more to do with compliance than fairness to the buyer. It is up to the buyer to do their due diligence and start analyzing with a view to negotiating early.

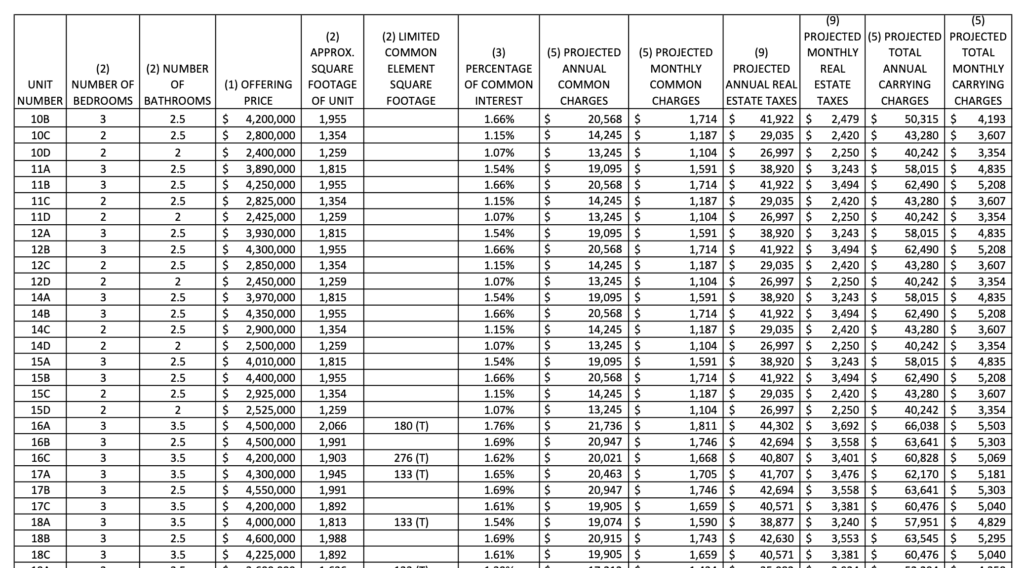

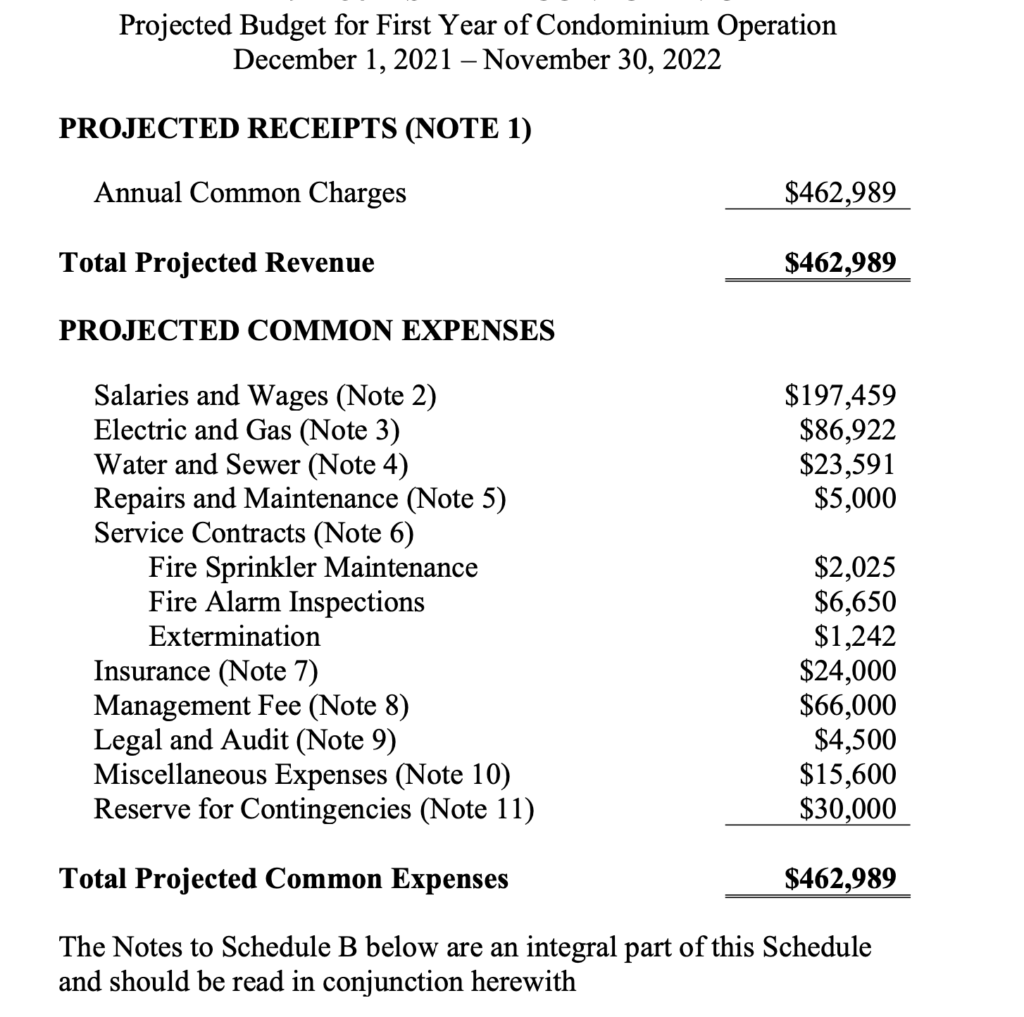

Your broker should be very focused on the Schedule B and any and everything to do with taxes, with the projected taxes shown on Schedule A. The Schedule B provides the basis for the common charges. Does the building have the proper staffing? This is usually one of the most expensive pieces of the common charges you will pay.

Vetting the Schedule B can help buyers understand if there may be a need for an increase in charges or also where a condo board might look for future savings. The taxes shown on Schedule A are typically derived from a tax opinion letter contained in the offering plan. The taxes also need to be looked at closely, and the tax opinion letter read carefully by your attorney. Per Jason Nazinitsky, “the taxes on the Schedule A only reflect the first year of operations of the condominium, starting with when the first unit closes. The tax letter may describe how the taxes can make a significant jump in year 2, a detail that is a common oversight by buyers and even their attorneys. Both common charges and taxes appear in some different spots in a larger offering document.

Special Risks

The first part of an Offering Plan will have a “Special Risks” section. This will detail the unique elements that could cause you concern. For instance, if you think you can park your car in a parking lot next to the development, you may discover that the developer of your condo owns the lot and plans another building next to yours. Not only will this take your spot, but it will also eliminate light and views.

If your development is a “mixed-use” building, i.e., the residential condos sit on top of a commercial space, the condos on top will have no say in who occupies the space below. A nail salon or organic market, no problem. A bar or nightclub, you might be concerned.

Other things to be wary of:

- No financing contingency. In a strong market where demand exceeds supply, the developer may try and throw this into the contract to make sure you close. The risk is if you don’t secure financing, you’ll lose your down payment.

- The condo building is a leasehold. This is more common in co-ops than condos. What this means is that the developer has rented the land that the building sits on. Once the lease runs out, the landowner can increase the rent, which will increase maintenance charges. On the off chance that the lease is actually set to expire in a decade or two, it’s doubtful that you’ll find any banks willing to give you a mortgage.

Schedule A

As briefly mentioned earlier, the Schedule “A” is crucial to understand. It is also in Part 1 of the Offering Plan and gives information on the individual units such as the offering price, number of beds, baths, square feet, maintenance fee, common charges, monthly and annual taxes (with and without tax exemptions), projected total carrying charges (with and without tax exemptions).

The Schedule “A” is also important because it gives the buyers a chance to see the full inventory of a condo instead of simply what the sales agent is marketing.

Also, a sponsor can make amendments to the schedule “A” regarding pricing. It’s not unusual to see big buildings submit many amendments to the pricing in schedule “A”. By analyzing these a buyer can gain an insight into the trajectory of sales and price trends. That’s why it’s important for a buyer to start analyzing a condo’s offering plans when they are still in the process of looking at potential homes to buy.

Schedule B

Think B for Budget. Schedule “B’ concerns the first year’s projected income and expenses. The calculations are calculated from an estimated date of when operations began. The rights of the developer to build more units and those unbuilt units carrying costs must also be taken into consideration. The offering plan provides a budget for the carrying charges for the individual units (including utilities) and any associated homeowner association.

Is anything negotiable in my condo offering plan?

The purchase price and the common charge, and everything else are 100% negotiable when you buy a condo. To be clear, the Offering Plan sets the amount of common charges. This number is not negotiable. But what you can negotiate is who pays the common charges. Much of it depends on how eager the developer is to sell the condo. Don’t simply assume that because you were quoted one price, that has to be the final price. The same goes for transfer taxes, closing costs, fixture upgrades, appliances, parking spaces, etc. If the developer has unsold units, they may be willing to do deals to get them off the books.

See Condo Buyer’s Worksheet, How to Craft an Offer Price.

Template of Condominium Offering Plan

Condominium offering plans may differ markedly from one another in their contents, but their layout generally follows a standard structure. It is as follows:

Cover Page

This will show the following:

Total Offering Price for the entire building which can include the following:

- Total number of residential units

- The total number of parking spaces

- The total number of storage spaces

Introduction

A brief overview of the building and a summary of the offering.

Description of Property (And Improvements if not a new construction):

This section briefly describes the components of the building and land.

Location and Area Information:

- A description of the location of the property, surrounding area including schools, hospitals and nearby public transportation.

Offering Prices And Related Information (Schedule “A”):

Described earlier

Budget for Operation of the First Year of Operation (Schedule “B”):

Described earlier

Compliance with New York Real Property Law 339(i):

- The method of calculating the percentage of common interest for a condominium building by a real estate expert.

Commercial Units (if Applicable):

- Use of unit and restrictions on use

- Rights of the commercial unit owner in the condo and the governance of the relationship between the commercial unit and the residential units.

Changes in Prices and Units:

- Offering prices in Schedule “A” must be changed with a filed amendment if it affects the price of the other units

- May also state prices and terms are negotiable and the sponsor may enter into an agreement with an individual purchaser to sell one or more units at prices lower than those stated in Schedule A without filing an amendment

- Will state that no change will be made to unit size or quality of common areas except with an amendment to the plan.

Accountant’s certified statements of operation (rental conversion to condo only):

- When the building is fully occupied a CPA will provide financial statements

Existing tenants (rental conversion to condo only):

- All leases may be inspected by potential buyers of the condo building

Interim Leases:

- States whether the owner of the building may rent out individual units to buyers under contract before they close, and the process for same.

Procedure to Purchase:

- Includes the details for the process of purchasing a unit, including how much the deposit it and where it will be held, whether any financing contingencies will be offered to all buyers and other terms that govern the sale of the unit by sponsor to buyers.

Effective date:

- An offering plan can only be declared effective when the Attorney General’s office deems it compliant with the conditions and schedules laid out in the plan. This includes signed purchase agreements for 15 percent of the condos in the building for vacant building (think: new build) conversions.

Terms of Sale:

- Includes information about the type of deed

- Certificate of Occupancy status (if Temporary, details of repairs sponsor needs to make after closing)

- Status of title and liens post-closing

- May include disclaimers about construction, such as what sponsor will not fix.

Unit closing costs and adjustments:

- All estimated closing fees and who is liable

Rights and obligations of sponsor:

- As described with reference to the offering plan

Control by the sponsor:

- Details how long sponsor may control the board of managers after the closing of the first unit and the consequences and risks to purchasers

Board of managers:

- Summarizes the declaration and by-laws of the condominium and how the condominium will be governed.

Rights and obligations of the unit owners and the board of managers:

- As described

Real estate taxes:

- Assessment of units with regards to taxes and abatements and the sponsor’s obligations in these matters. This section will often either include the tax opinion letter or will at least summarize it and reference where the tax opinion counsel can be found.

Sample offering plan

Below is a full offering plan for the condo at 30 Warren St in Tribeca, Manhattan.

CD150080_30-Warren-Condominium_Offering-PlanMarketproof Pro

By using Marketproof Pro, you will be able to search both publicly listed properties and unlisted off-market properties not available on popular listing sites. Marketproof can increase the inventory you see by 9-10x what you may see on other sites.

Create an account and get a seven-day free trial.

Marketproof Pro

Image: 96 + Broadway