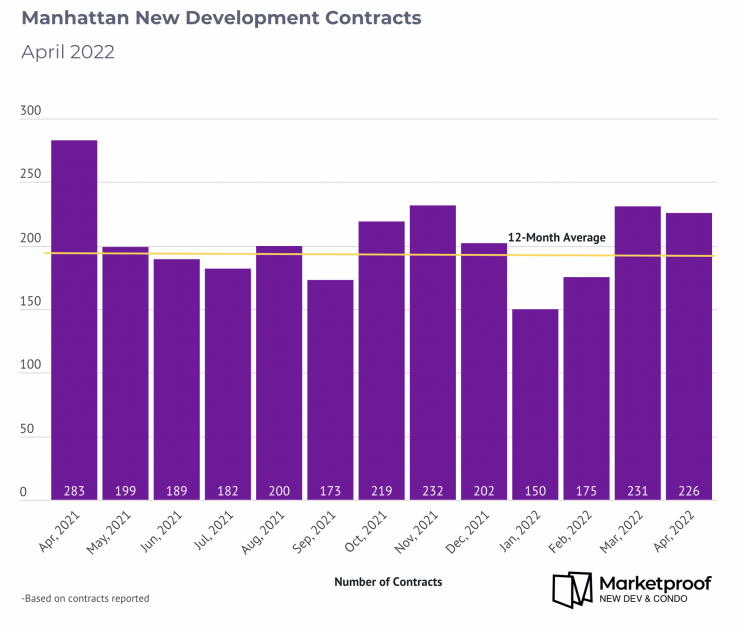

New York City’s new development market reported 397 sponsor contracts in April 2022, showing a 14% drop in overall volume from March that was more pronounced in the outer boroughs. Manhattan had a slight 3% dip while Brooklyn and Queens saw 26% and 24% fewer transactions respectively, suggesting the city’s center of gravity is shifting back toward Manhattan. Despite the decrease, contract volume is still 45% higher city-wide than the same period in 2019, before the pandemic.

The overall aggregate dollar volume dropped 7% from March to April 2022, while the median price per square foot and median unit price were essentially unchanged for the second month in a row, indicating that price growth is continuing to level off across the city as activity follows suit.

On the heels of significant changes to the lending climate, New York City is leading into the spring housing market on a trajectory that appears to be headed for “normalcy.” Deal flow is tempering from last year’s boiling point, price growth is stabilizing and long-term appreciation appears healthy – even sustainable. When comparing April 2019 to 2022, we see 7% growth in median price per square foot and 12% growth in median unit price occurring over the course of several years while markets like Miami are seeing that happen in just a year.

Read the complete report analyzing market performance in Manhattan, Brooklyn, and Queens according to key metrics: contract volume, median price per square foot, sales velocity, and top contracts, closings, and buildings.