Since the first Manhattan condo was launched in 1965, nearly 3,000 condos have been developed with 115,000 units. Before condos, though, Manhattan was filled up with co-ops.

You might expect that condo sales would have overtaken co-op sales by now. After all, condo development has towered over co-op development for nearly sixty years. In this post, we’ll explain why there are still more co-op than condo sales. The answer may surprise you.

Sales by Property Type

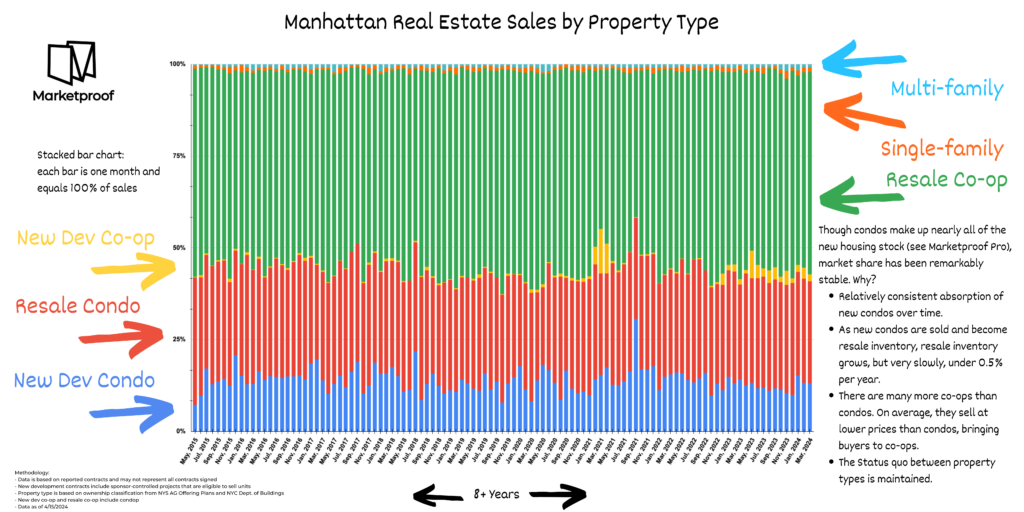

First, let’s look at the sales over the last eight years. In the chart below, each bar shows one month’s sales. The sales for each property type are stacked on top of the other so that the bar represents 100% of sales.

Click to expand the chart

New Development Condos

At the bottom of the chart in blue are new development condos. The market share of this prized category is consistent, suggesting that condos get absorbed into the market at a fairly constant rate. (Learn about ‘shadow inventory‘).

Resale condos

Above new development condos is resale condos in red. Whereas new development condos are sold by real estate development companies, resales are primarily by homeowners. The percentage sold by condo homeowners is also fairly consistent, and the addition of new condos into this pool is statistically small. With 364,000 sellable housing units in Manhattan, the addition of 1,500 condo units each year adds a mere 0.4% to the total available inventory.

New development co-ops

Next, in yellow, is new development co-ops. Clearly, building co-ops has fallen way out of favor. There are a bunch of reasons for this, including that condos are easier for developers to sell and are a more attractive product to many of today’s buyers, e.g., no co-op board to get through.

Resale co-ops

Next, we get to resale co-ops in green. This is the largest segment at 58% of sales. While, as said above, condos are pretty much all that is built these days, and they are overall easier to buy and sell, co-ops still have the largest share because there are more of them. Today, there are 4,386 co-ops with 215,000 units. Co-ops account for nearly two-thirds of the inventory.

Sales by Price

Now, let’s look at prices.

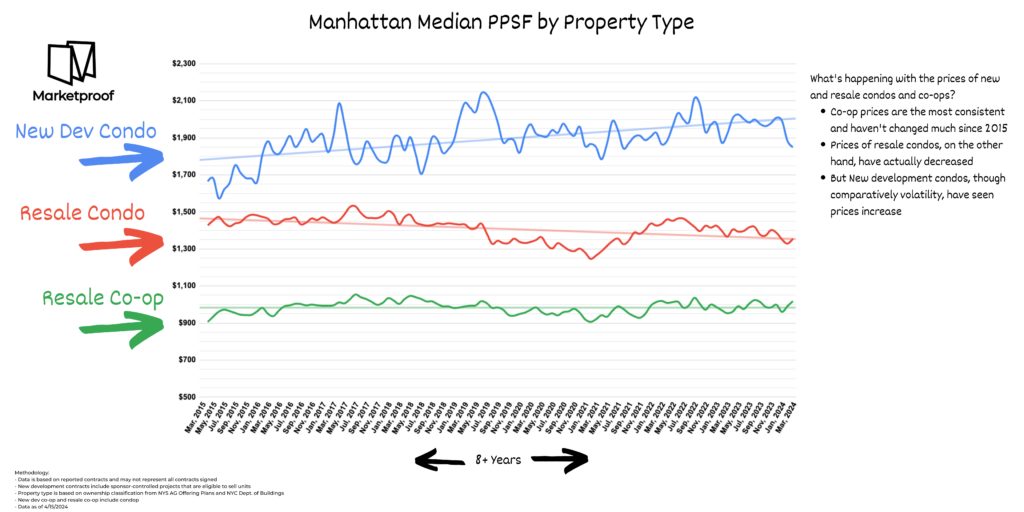

The chart below is clear: Shiny new condos get a premium to resale condos, and resale condos get a premium to co-ops. More, the premium between new and resale condos has widened significantly since 2015. In 2015, a new condo sold for an average of 14% more than a resale condo; in April 2024, that premium rose to over 36%.

The premium between resale condos and co-ops has fluctuated since 2015 but has remained relatively consistent, reaching a high of 36% in the Spring of 2015 and a low of 23% in the Fall of 2020. As of April 2024, a resale condo sold for 25% more than a co-op.

Click to expand the chart

Adding it all up

When you add it all up, though developers don’t build many co-ops these days, they also don’t build enough condos to overtake the number of co-ops. The result is that co-ops have maintained market share but at lower prices than resale condos and much lower prices than new development condos.

Marketproof Pro

If you are in the market to buy a new or resale condo, co-op, or townhouse, work with a broker who has access to all of Marketproof’s information and can help you get the best deal. Learn more here >>

Top Images courtesy of The Q, The Rushmore, and One High Line