“I’m a features reporter for the New York Times,” began the email I received last month.

The reporter, Steven Kurutz, was working on a story about the evolution of Williamsburg, Brooklyn.

And he sought Marketproof’s input to make it happen.

The article – which aimed to chronicle Williamsburg’s transformation from a bohemian industrial zone to a desirable luxury development site — would appear in the Times’ Styles Section. It would not be a straight-up real estate story, but it needed data and a market expert’s commentary to illustrate its premise.

At Marketproof, we do very little paid advertising. Instead, we promote our brand through our content, sharing unique data and analysis with wide-reaching media outlets like the New York Times, Bloomberg, and The Wall Street Journal. Real estate trade publications like The Real Deal and Inman seek us out, too.

They all use our data, quote me, and then link back to the Marketproof website. It’s a win all around. The publication gets a source they can rely on, and we grow our credibility and attract new clients.

I replied to Steven’s email, and we scheduled an interview that same day. In a 30-minute call, we talked generally about Williamsburg and its history.

Then, my team and I got to work on getting some data. Using our website, Marketproof Pipeline, we identified 135 active and recently completed development projects in Williamsburg that were greater than 25,000 square feet — the most of any neighborhood in the city.

Steven’s story, published on January 29, was titled “Williamsburg. What Happened? A four-decade timeline of total transformation in Brooklyn.” It was structured as a linear timeline and featured archival and new photos that showed Williamsburg’s then-and-now in sharp contrasts.

The chronology ended with Marketproof’s “most-of-any-neighborhood-in-the-city” data point and one of my quotes:

“You have a combination of age, demographics, and wealth that are all concentrated in that area,” said Kael Goodman, the head of Marketproof, an analytics company that specializes in New York real estate.

The article depicted Williamsburg’s cultural scene and its storied and sometimes quirky gathering places. But there’s an important real estate story to share as well.

Our analysis traced the transformation of the neighborhood to a single point of municipal history: the 2005 rezoning of Williamsburg and Greenpoint, which allowed for the construction of housing and made the waterfront accessible to the public.

That single regulatory change set the stage for a remarkable real estate market expansion. In fact, much of the area’s development happened in the immediate five years after the rezoning—from 2005 to 2010.

The numbers are telling. So I thought we’d share some behind-the-scenes Williamsburg data points that didn’t make the Times story’s final cut.

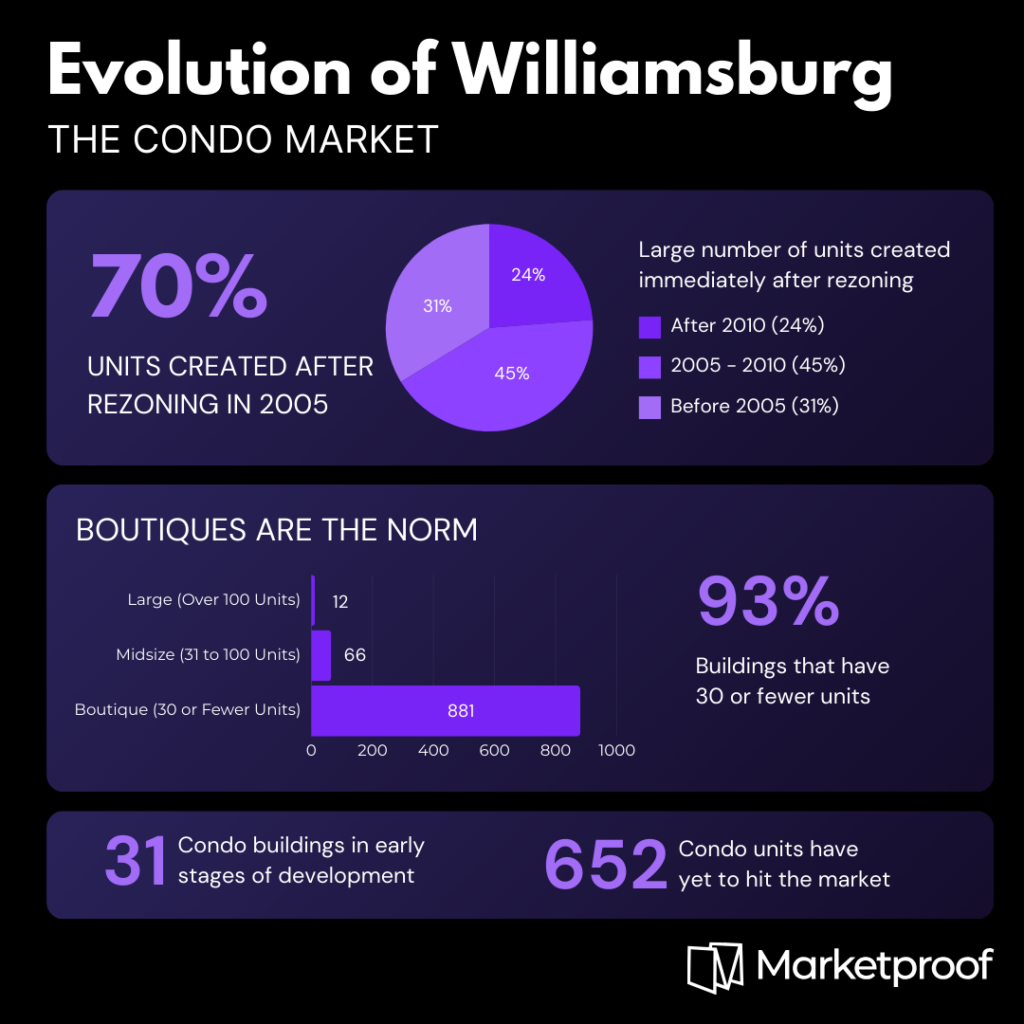

The Condo Market

- Nearly 70% of today’s condo units were created after the rezoning. There are a total of 10,819 condos in Williamsburg. Of these, 45% (4,597 units) were completed between 2005 and 2010, and 24% (2,573 units) were completed after 2010.

- ‘Boutique’ buildings are the norm. There are 946 condo buildings. Of those, 93% (881) are classified as ’boutique buildings,’ with 30 or fewer units. Only 1% of the buildings—or 12 in total – have over 100 units. The remaining 7% are ‘midsize buildings,’ with between 31 and 100 units.

- A healthy condo pipeline. There are currently 34 new buildings with a combined 411 units listed for sale. Additionally, 31 buildings are in the early stages of development and account for 652 units that have yet to reach the market.

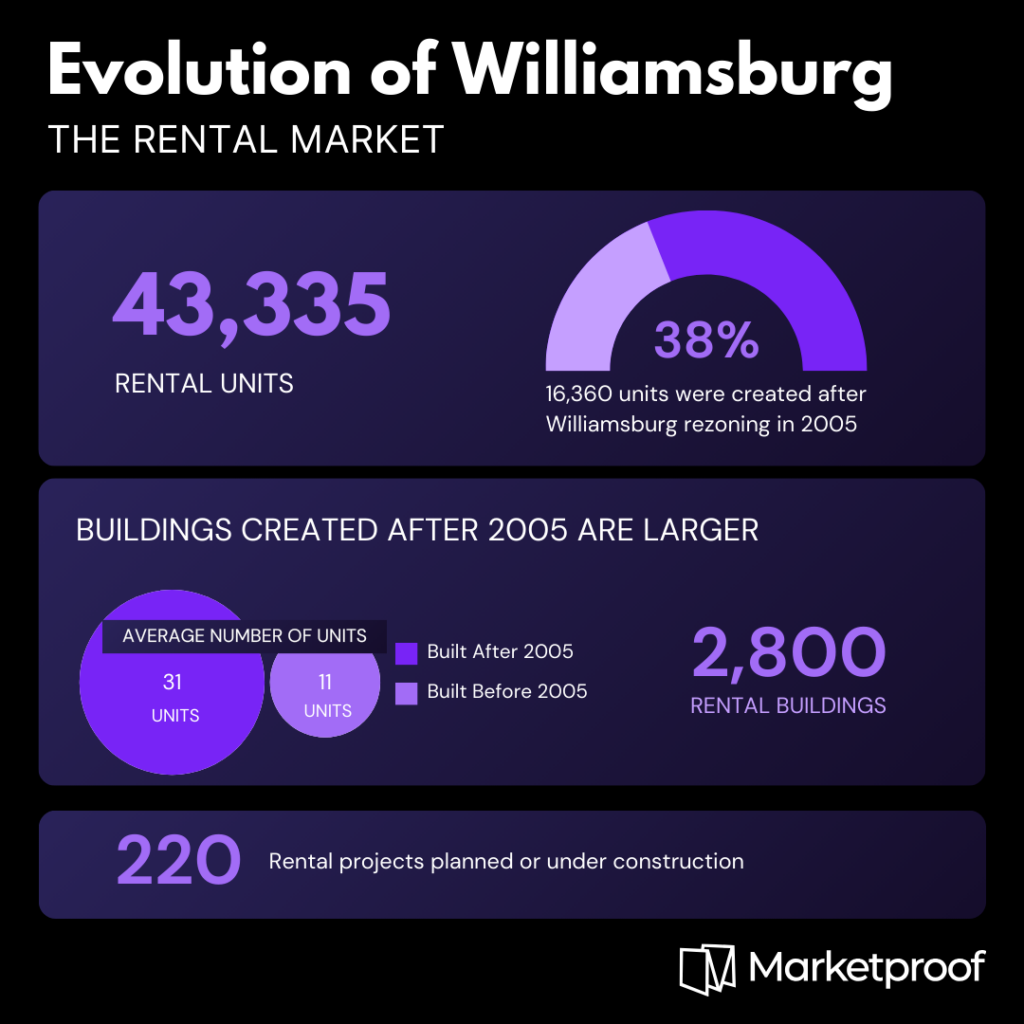

The Rental Market

- 16,000 new rentals post-rezoning. There are 43,335 rental units spread across more than 2,800 buildings in Williamsburg. Of these, 38%, or 16,360 units, were created in 2005 or later.

- Buildings created after 2005 are larger. Rental buildings in Williamsburg constructed before 2005 averaged 11 units. Buildings developed or converted after 2005 were significantly larger, averaging 31 units. This represents a 300% increase in size compared to the pre-2005 buildings.

- 220 rental projects under development. The rental market continues to grow, with 220 buildings planned or currently under construction. Most of these developments are smaller, with under 25,000 square feet.

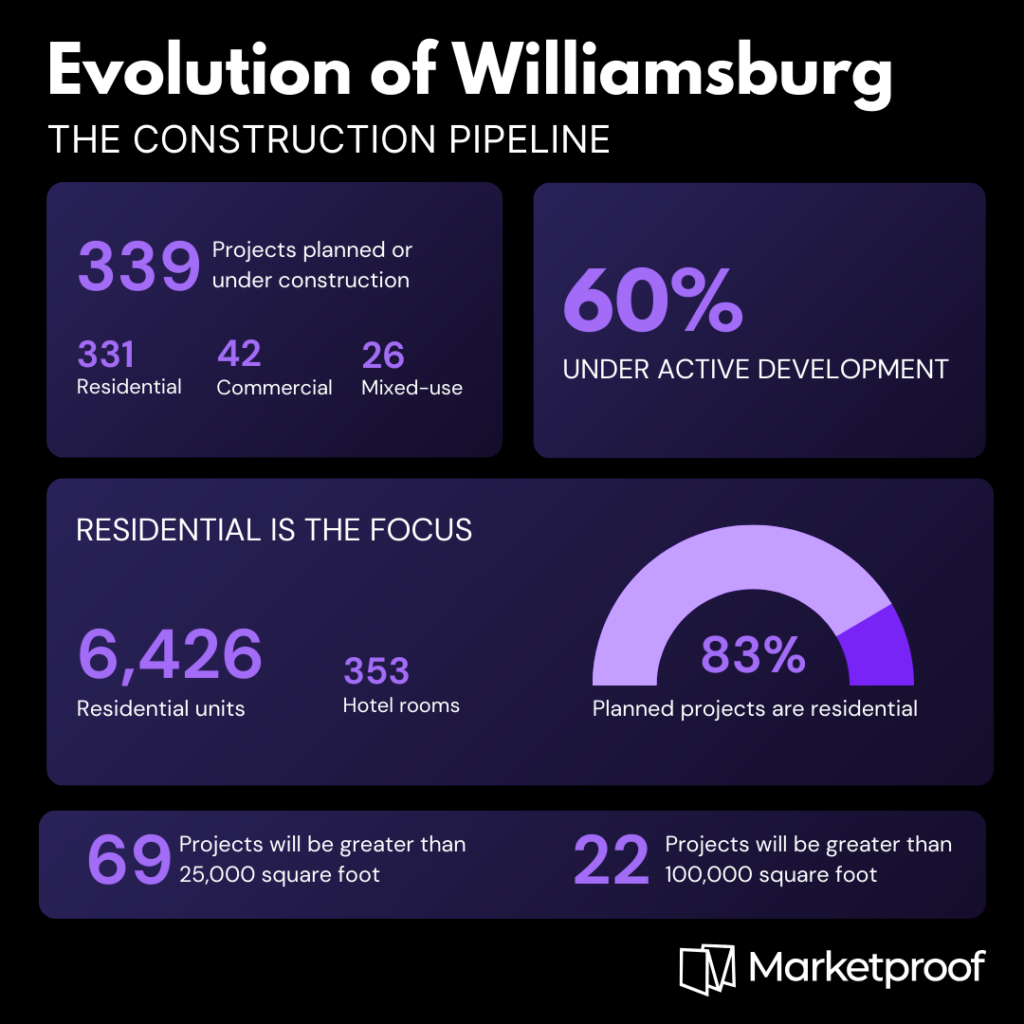

The Construction Pipeline

The Williamsburg neighborhood continues to grow, although at a more measured pace. There are 399 projects under development now.

- Residential is the focus. Of the projects under development, 83% (or 331 of them), are residential. These projects propose a total of 6,426 dwelling units, with a significant portion of them expected to be rentals.

- Mixed-use projects, which combine residential and commercial spaces, account for 26 of the projects under development now, or approximately 0.7%.

- Hotel rooms account for a smaller sliver of ongoing development, with 353 units planned.

- More than half (or 206) of the planned development projects are actively under construction.

Today’s data paints a portrait of a Williamsburg that is still evolving. But the years 2005 to 2010 can be recorded as the unmistakable turning point in the neighborhood’s history.

Kael Goodman is the co-founder and CEO of Marketproof. Follow him on Instagram.