Here in New York City, we spend a lot of time talking about how unaffordable everything is (That cocktail is $20? You pay $3,000 a month to live in 300 square feet?), but the truth is that there’s an entire governmental system dedicated to protecting and expanding the city’s stock of affordable apartments. When it comes to affordable housing, there are plenty of intricacies that even the most seasoned real estate professionals may be unaware of. Ahead, we break down the ins and outs of affordable housing for investors, developers, and curious New Yorkers.

What is affordable housing?

Very generally speaking, affordable housing is that which is below-market-rate and regulated by city government. It is overseen by the New York City Department of Housing Preservation and Development (HPD) and the New York City Housing Development Corporation (HDC)

There are three kinds of affordable housing:

Affordable housing calculated by AMI

This is the more common type of affordable housing. We’ll break it down in the sections below.

Mitchell Llama

The Mitchell-Lama program was created in 1955 to provide “affordable rental and cooperative housing to moderate- and middle-income families,” according to HPD. There are both city- and state-sponsored Mitchell Llama programs. Most Mitchell Llama buildings or developments have long-term affordable commitments (50+ years), and applying to these sites usually requires adding your name to a waitlist. Requirements and waiting lists can be found here.

Section 8

Also known as the Housing Choice Voucher (HCV) program, Section 8 provides federal funding for subsidies that help eligible low-income families pay rent in designated buildings. Typically, households in this program pay 30 percent of their monthly income toward rent. Section 8 is overseen by the New York City Housing Authority (NYCHA).

For the purposes of this article, we’ll be focusing on affordable housing calculated by AMI.

How are the rents determined?

New Yorkers must meet a certain income threshold to qualify for affordable housing. This is determined through Area Median Income (AMI). As described by HPD:

The median income for all cities across the country is defined each year by U.S. Department of Housing and Urban Development (HUD). The 2021 AMI for the New York City region is $107,400 for a three-person family (100% AMI).

HUD arrives at this figure by using data from the agency’s most recent American Community Survey. Something very important to note is that the NYC “region” is not just the five boroughs, but also Westchester, Rockland, and Putnam counties. Households in these counties tend to have much higher incomes than in New York City, which is why many believe HPD’s affordable housing guidelines are skewed.

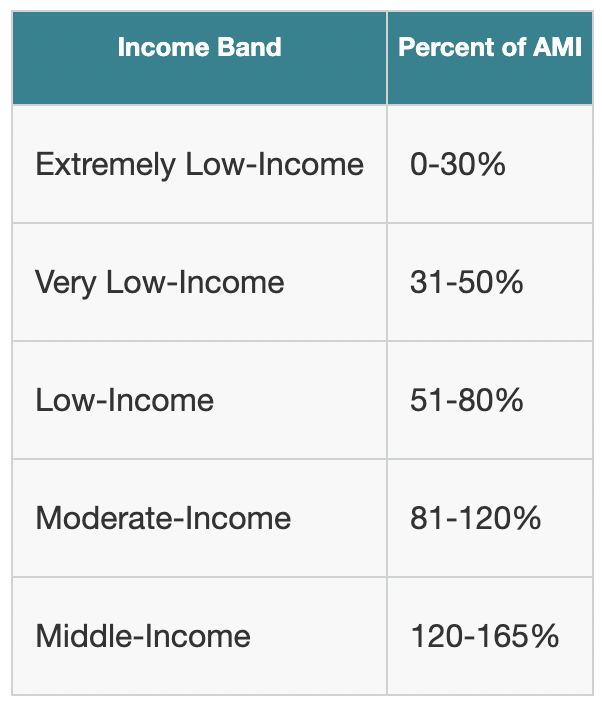

In the graphic above, you can see what percentage of the AMI households need to be earning in order to qualify for which brackets of affordable housing. To see how this changes based on the number of people in one’s household, you can visit this link.

The moderate and middle-income brackets have also been controversial, as oftentimes these rents are not that much lower than market-rate. However, HPD’s reason for including these units is that they act to subsidize the low- and extremely low-income units.

Check out Marketproof New Development for the most information anywhere on NYC condos.

How does the city determine how many units are affordable?

There are various ways in which a building can include affordable units or be built as all-affordable. In many cases, HPD finances the new construction of affordable housing. These programs include:

Extremely Low & Low-Income Affordability (ELLA) Program

HPD provides funding for multi-family rental projects in which a minimum of 80% of the units are at low-income rents affordable to households earning up to 80% of Area Median Income (AMI).

Housing+

This initiative is carried out in partnership with the owners of current HUD-assisted properties, Mitchell-Lamas, and developments financed through past city disposition programs. The program adds new housing on underutilized land (such as parking lots) while rehabilitating and financing the existing developments.

Inclusionary Housing Program (IHP)

This initiative was designed to preserve and promote affordable housing within neighborhoods where zoning has been modified to encourage new development. This is overseen by the Division of Inclusionary Housing and includes two sub-programs:

- Voluntary Inclusionary Housing (VIH): In these zoning districts, a development can receive a density bonus (to increase residential floor area on-site and/or off-site) in return for the new construction, substantial rehabilitation, or preservation of permanently affordable housing

- Mandatory Inclusionary Housing (MIH): This program was enacted in 2016 as part of Mayor de Blasio’s ambitious affordable housing agenda. It requires all new developments, enlargements, or conversions that exceed either 10 units or 12,500 square feet of residential floor area to include permanently affordable housing.

Mixed-Income Program: Mix & Match

HPD funds mixed-income, multi-family rental projects with a range of affordability tiers. To be eligible, projects must set 40-60 percent of the units aside for households earning up to 80 percent of the AMI and the other 40-60 percent for households earning up to 120 percent of the AMI.

Neighborhood Construction Program (NCP)

This initiative funds the construction of rental housing on vacant or underused city-owned land. These projects must have up to 30 units affordable to low-, moderate-, and middle-income households earning up to 165 percent of the AMI.

Open Door Program

This program funds the construction of co-ops and condos affordable to moderate- and middle-income households. It has been very rare in recent years, for affordable homeownership opportunities to become available.

Senior Affordable Rental Apartments (SARA)

HPD provides low-interest loans for construction and renovation of affordable housing for those 62+ years in age with low incomes. These projects must also set aside 30 percent of units for homeless seniors.

Supportive Housing

Supportive housing developments have permanent, affordable apartments, as well as on-site support services to serve communities such as homeless individuals and people with disabilities. These buildings must be owned and operated by experienced community organizations. Oftentimes these organizations will work in partnership with larger real estate developers.

How do I receive financing for an affordable housing project?

We just broke down the various requirements for different types of affordable housing, but how exactly does the city go about financing these projects? There are different mechanisms for investors and developers.

Investors

HDC primarily facilitates investments in affordable housing through its Multi-Family Housing Revenue Bond Resolution (Open Resolution), which is the agency’s largest single asset.

Three years ago, the agency introduced Sustainable Development Bonds (SDB) to “allow investors to invest directly in bonds that finance the new construction and preservation of affordable housing projects that stimulate economic growth and contribute to the stability and revitalization of neighborhoods across New York City,” according to HDC. These investments also address environmental benefits. Examples of these projects include the Bronx’s La Central and Crown Heights’ Bedford Union Armory.

In January 2020, HDC began issuing bonds through the Housing Impact Bond Resolution (Impact Resolution), which specifically finances NYCHA developments.

Developers

HDC is currently working to develop affordable housing through the city’s Housing New York 2.0 plan, which came about from an initiative put forth in 2014 under the de Blasio administration to create and preserve 200,000 affordable homes in 10 years. When it was clear that this goal would be reached two years ahead of schedule, the plan was adapted for a total of 300,000 affordable units by 2026. Housing New York 2.0 is the roadmap for this accelerated plan.

New construction programs fall under the following two categories from the list in the previous section:

- Extremely Low & Low-Income Affordability Program (ELLA): The city provides developers tax-exempt bonds and as of right ” 4%” Low-Income Housing Tax Credits used in conjunction with HDC’s corporate reserves to create low-income housing

- Mixed Income Program: Mix & Match: The same framework as detailed above to create low, middle, and moderate income housing

Preservation programs fall under the following five categories:

- Neighborhood Pillars Program: The city provides financing for non-profits to purchase or rehabilitate existing rent-regulated buildings and keep them affordable

- Preservation Program: The city provides financing for developers to rehabilitate and upgrade existing multi-family developments and preserve low-income housing

- Mitchell-Lama Reinvestment Program: The city provides financing for developers to acquire, rehabilitate, and restructure existing debt to preserve Mitchell-Lama developments

- Repair Loan Program: The city provides financing for developers to rehabilitate Mitchell-Lama developments

- PACT Preservation Program: In partnership with NYCHA, HDC provides financing to rehabilitate, recapitalize, and preserve NYCHA properties

Real estate developers can submit their proposed projects to HDC through the HDC Housing Developer Intake portal.

What are the pros and cons of developing affordable housing?

The biggest pros of including affordable housing in one’s development are the tax credits and incentives.

The current tax credits offered by the city are:

- Low Income Housing Tax Credits (LIHTC): Tax credits for new construction or rehab projects with low-income set-asides.

- 420-a: Complete tax exemption for HDFC-owned housing with on-site social services.

- 420-c: Complete or partial tax exemption for low-income housing developed with tax credits.

- 421-a: Partial tax exemption for new multiple dwellings

- 421-b: Partial tax exemption for new construction or substantial rehabilitation or owner-occupied one- and two-family homes.

- 421-g: Tax exemption and abatement for conversion of commercial buildings to multiple dwellings in downtown Manhattan.

- Article XI: Tax exemption for HDFC-owned new construction or rehabilitation.

- J-51: As-of-right tax exemption and abatement for residential rehabilitation or conversion to multiple dwellings.

- UDAAP: Tax exemption for rehabilitation or new construction of housing in UDAAP areas.

Another major incentive is Inclusionary Zoning, which is a Department of City Planning program that provides an optional floor area bonus for the creation of preservation of affordable housing. There are two qualifying programs that allow developers to receive this bonus:

R10 Program

This original program provides a floor area bonus of up to 20 percent, increasing the maximum Floor Area Ratio (FAR) of 10.0 to 12.0 for the inclusion of affordable housing in projects located in applicable residential and commercial districts with R10 density. The R10 zoning districts are those that have the highest residential density, such as parts of Long Island City, Downtown Brooklyn, and Midtown Manhattan.

Inclusionary Housing designated areas

These are special medium- and high-density residential and commercial zoning districts, where new developments setting aside 20 percent of units as affordable can receive a bonus of 33 percent of floor area.

What are the cons of developing affordable housing? The main drawback is the additional paperwork and city processes that are required. This is likely to persist throughout a project’s lifespan, as HDC and HPD require regular check-ins. Of course, affordable units will not bring in as much revenue, but this is where the tax credits come in to offset the loss.

+++

Learn more about NYC policy here:

- Everything you need to know about rezoning in NYC

- NYC ULURP Review Process

- NYC property taxes: all you need to know

This article is not an official New York City resource. For all questions regarding affordable housing, call 311.

Marketproof New Development

Lead image of Bankside development Credit: ArX Solutions