Guest post by Pierre Debbas

Time heals all wounds, but when you look back 15 years ago, we experienced the worst financial crisis in America since the Great Depression. We lived in a world where subprime lending was rampant and created a bubble that tore apart the housing market and nearly destroyed our banking industry. We witnessed the largest bank collapse in U.S. history, Lehman Brothers. Millions upon millions of homes were underwater or foreclosed on. The world appeared to be ending. Then the government stepped in, issued trillions of TARP money, and rescued the financial system. Given the passage of time, we forget these events’ magnitude and their impact on the real estate market.

Luckily for our NYC market, we were insulated from subprime lending due to financing restrictions co-op imposed as well as more responsible underwriting regulations that our banks in the area have. It is funny to look back and remember that the phrase “financing contingency” was not a part of the English language at the time. It was a given that anyone would qualify for a mortgage, and before the financial crisis, our market skyrocketed due to easy access to debt as well as a construction boom that started after September 11th.

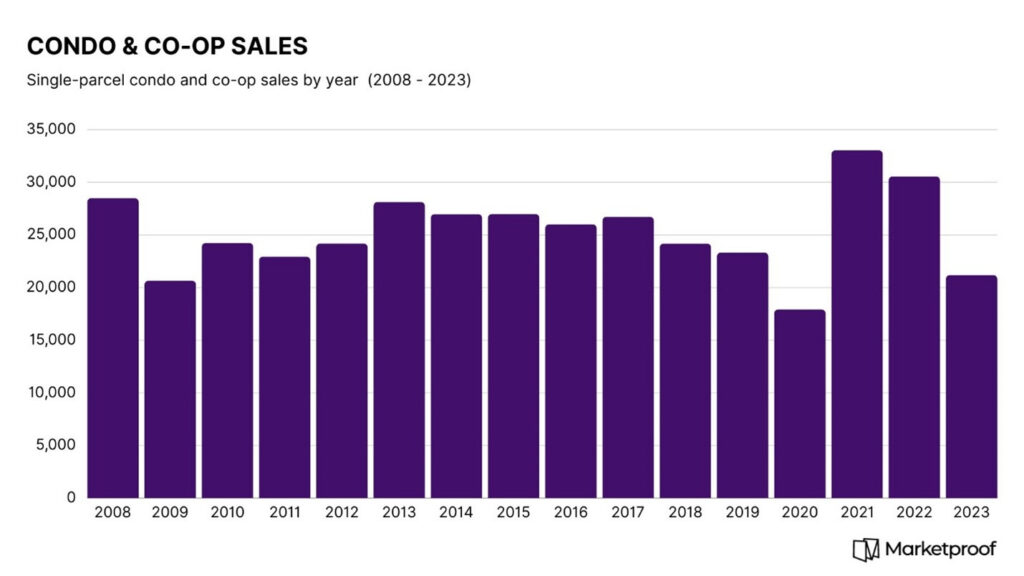

Fast forward to 2023, which has many similarities to 2009 that most people will be shocked to hear. Was our financial system on the brink of collapse in the same manner as in 2009? The answer is no. However, did we experience the next three largest bank collapses in U.S. history? The answer is yes. Are we sitting here today speculating on the viability of regional banks? Yes, undoubtedly. Has the Federal Reserve’s steady and drastic increases of interest rates in 2022 and 2023 been a slow and painful demise to the real estate and banking industries? Unfortunately, yes. When you look at the NYC market, which is largely insulated from many economic factors impacting the rest of the country, you will see a glaring similarity between co-op/condo transaction volume in 2009 and 2023. According to leading real estate data and analytics company Marketproof, there were 20,658 co-op/condo transactions in 2009 and only 535 more in 2023 (a 3% increase). 2023 transaction volume was 31% less than in 2022 and 36% less than in 2021. In comparison, 2009 was only 28% lower than 2008.

But you will say we did not have a financial crisis last year, so why are there glaring similarities? The reason is simple, interest rates. Ever since the financial crisis, we have been living in a low-interest-rate environment. That is close to 15 years of low cost of funds which has created the current valuation of our real estate market. These values are predicated on low to moderate interest rates. The values of real estate in NYC and most of the country have held steady, which is counter-intuitive to the Fed’s goal of bringing down pricing by increasing rates. The sole reason for this is supply. If you look around NYC, you will not notice one crane in the sky. If you think back 10-15 years ago, cranes created inventory everywhere. One of the major impacts 2009 had on the real estate market is that it stalled housing development throughout the country. We believed there was a glut of supply of housing back then and given the subprime crisis, many developers went under or steered clear of developing homes. Thus today, we are in a drastic shortage of supply.

The second half of 2022 and all of 2023 witnessed over a 500-basis point increase in rates. This represented an unprecedented increase which has completely stalled all activity in the real estate market. When transaction volume mirrors that of the financial crisis, you have a major problem. In addition, all this has created is a further wealth gap in society. According to Douglas Elliman’s Q4 2023 market report, nearly 68% of all buyers in Manhattan paid cash for their apartments. 68%!!!!! We are seeing far more activity in the ultra-high-end market of $5 million and up than we are in the market of what I like to call “semi-normal people” in the $1 – $3 million range. Rents have increased to record levels in NYC as a result of this, and developers throughout America are building “build to rent homes” as opposed to homes for people to purchase. The imminent reduction of interest rates cannot come soon enough for the real estate market.

Pierre E. Debbas is a partner and founding member of the law firm Romer Debbas. Pierre has extensive experience in the areas of real estate and general business law. His practice focuses on the purchase and sale of commercial and residential real estate in New York City, commercial leasing, real estate-related financing matters, representation of cooperative and condominium boards, foreign investors, and small businesses. Over the course of his career, Pierre has been involved in thousands of real estate transactions and is instrumental in his firm’s annual ranking as one of the top transactional firms based on the volume of transactions closed in NYC.