The HUD-1 Settlement Statement is a government form that was used widely before 2015 when buying, selling, and refinancing real estate. It lists all the charges and credits to the buyer and seller in a real estate settlement or a mortgage refinance. You will also hear people refer to it as a settlement or closing statement.

A settlement agent, or closing agent, prepares a HUD-1 Settlement Statement. Reverse mortgages and mortgage refinancing still use this form. However, almost all other real estate closings these days use the Closing Disclosure, or CD. The CD replaced the HUD-1 beginning Oct. 3, 2015.

Key elements of a HUD-1 Settlement Statement

The HUD-1 states all the transactions that have occurred prior to the actual closing. These include:

- Loan fees

- Insurance

- Taxes

- Assessment fees

- Commissions

- Escrow payments

Check out Marketproof New Development for the most information anywhere on NYC condos.

When do I receive a HUD-1 Settlement Statement?

In accordance with the Real Estate Settlement Procedures Act (RESPA), borrowers must receive a copy of the HUD-1 Settlement Statement at least one day before settlement. In reality, as utility charges and rental information (in an investment property) are often collated at the last minute, this form is not always tabulated until shortly before the closing.

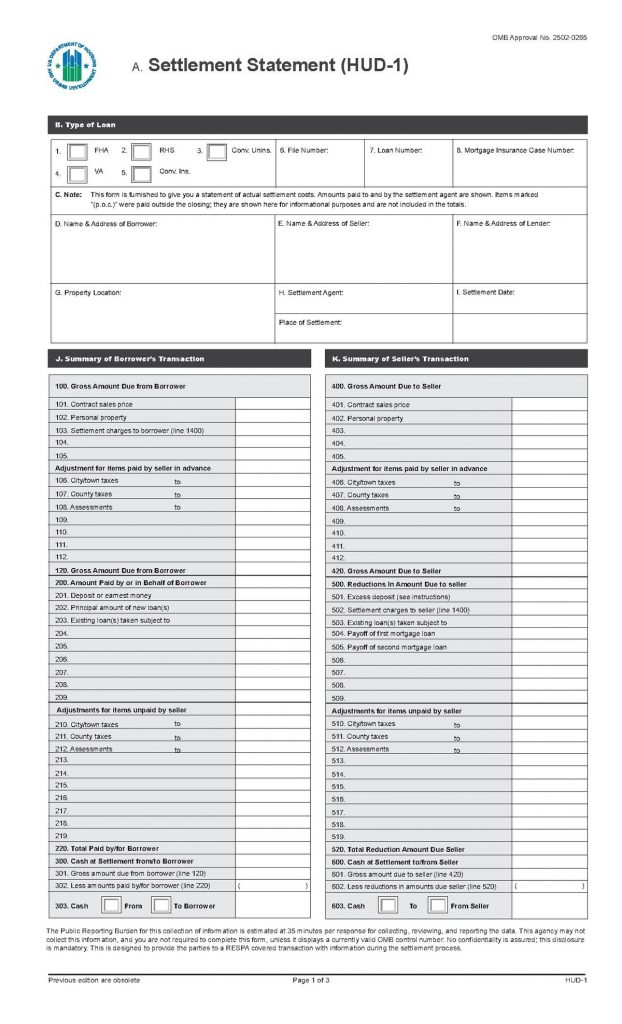

What does a HUD-1 look like?

The statement is divided into two columns. The left lists all charges to the borrower and the right all those to the seller.

The breakdown of the pages is as follows:

Page One

- The gross amount due from the buyer and to the seller including contract price, the total amount of the settlement charges, and fees extracted from the final total on page 2 (Line 1400)

- Adjustments for items paid in advance by the seller – calculated mostly from taxes paid

- Amounts paid on behalf of the borrower and reductions in the amount due to the seller

- Adjustments for items unpaid by the seller

- Cash at settlement due from or to the buyer and seller

Page Two

The second page details the associated fees and charges involved in the transaction. There are again two columns with charges that the buyer and seller pay. This page features the following:

- Broker fees

- Fees related to the loan

- Items the lender must pay in advance

- Deposits reserved with the lender

- Title charges

- Government recording and transfer charges

- Any additional settlement charges

Page Three

Page 3 relates to the figure in the Good Faith Estimate (GFE) which has been replaced by the Loan Estimate. The lender would have supplied GFE estimate figure to the settlement agent upon application of the loan. The HUD figures are listed side by side with the GFE so that a comparison can be made and discrepancies highlighted. The standard loan terms shown here will include the origination fee, interest rate, term, and payment.

Sample HUD-1 Settlement Statement

HUD1Link to the form above: https://blocksandlots.com/wp-content/uploads/2020/01/HUD1.pdf

Getting started with Marketproof

With Marketproof New Development, you can easily search both publicly listed properties and unlisted off-market properties not available on popular listing sites. Marketproof can increase the inventory you see by 9-10x what you may see on other sites. Create an account today and get a 7-day free trial.

Top photo courtesy of 11 Hoyt St.